Economy Poised to Slow, Leading Indicator Shows

Source: US News and World Report/Reuters

June 20, 2025, at 10:56 a.m.

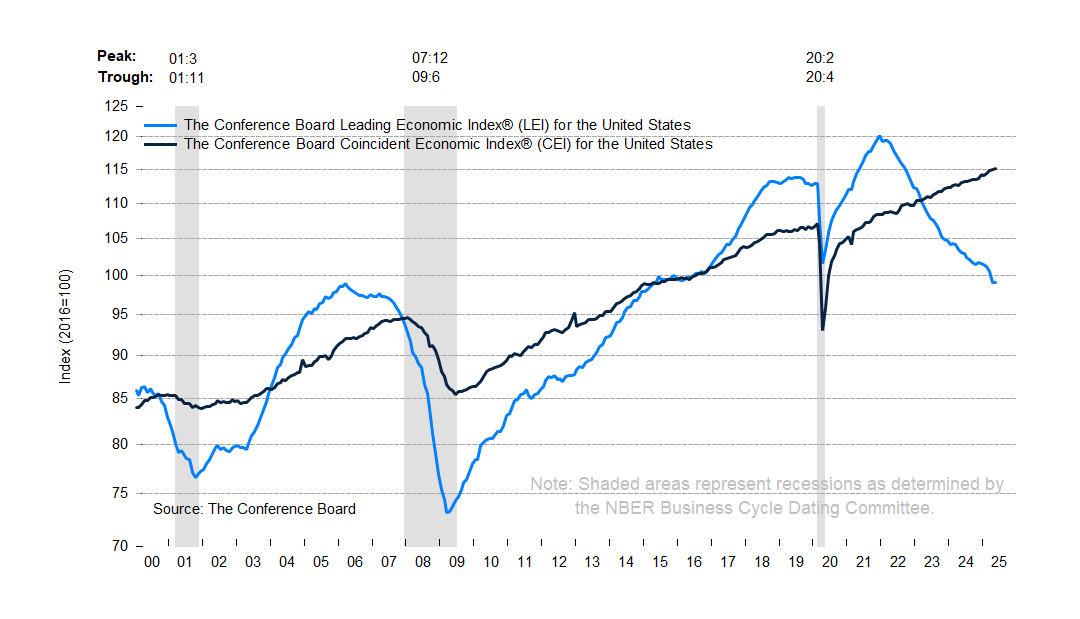

A gauge of future economic activity fell again in May following a downward revision for April as consumer pessimism continued to grow amid worries about the labor market, inflation and the imposition of import tariffs.

While May’s drop of 0.1% in the Conference Board’s leading economic index was an improvement on April’s 1.4% decline, it leaves the six-month trend close to recessionary levels. The index has fallen by 2.7% in the six months leading up to May, a sharper downturn than the 1.4% dip in the prior six months.

“The LEI for the U.S. fell again in May, but only marginally,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators, at The Conference Board. “The recovery of stock prices after the April drop was the main positive contributor to the Index. However, consumers’ pessimism, persistently weak new orders in manufacturing, a second consecutive month of rising initial claims for unemployment insurance, and a decline in housing permits weighed on the Index, leading to May’s overall decline.”

“With the substantial negatively revised drop in April and the further downtick in May, the six-month growth rate of the Index has become more negative, triggering the recession signal,” Zabinska-La Monica said in a written analysis. “The Conference Board does not anticipate recession, but we do expect a significant slowdown in economic growth in 2025 compared to 2024, with real GDP growing at 1.6% this year and persistent tariff effects potentially leading to further deceleration in 2026.”

Read more: https://www.usnews.com/news/economy/articles/2025-06-20/economy-poised-to-slow-leading-indicator-shows

Link to the Conference Board PRESS RELEASE - The Conference Board Leading Economic Index® (LEI) for the US Inched Down in May

PSPS

(14,626 posts)The economist they interviewed said that the accuracy and reliability of statistical figures coming from US federal agencies is beginning to show unusual discrepancies with those compiled privately, portending the government "fudging" their figures to conceal the true state of the economy.

(Note that The Conference Board being quoted here is not affiliated with any government.)

BumRushDaShow

(155,044 posts)because I kept using their spot WTI stuff. ![]()

Have to go dig through the site (they have so much there).

anciano

(1,862 posts)not sure where it will now lead with the Fed and the interest rate picture, but we shall see.